According to CRIF – EURISC Credit Information System data, the demand for mortgages by Italian families maintained a negative trend for the entire 12 months of 2023, where the overall annual figure recorded a -17.2%.

However, the progressive rise in interest rates has pushed families towards subrogation operations. In September, in fact, the subrogation phenomenon stood at -5.2%, while new mortgages granted fell by -24.0%.

Trend in the number of requests for new mortgages and subrogations

Source: Eurisc – CRIF Credit Information System

Source: Eurisc – CRIF Credit Information System

The average amount requested remains stable (+0.1%), with a total value of 144,659 euros. In fact, if we consider the month of December alone, there is a further leap of +5.0% which pushes the average amount to a record amount of 152,550 euros. Therefore, both the annual and monthly data represent a peak value never reached in the last 10 years.

Simone Capecchi, CRIF Executive Director declared“ After the setback that characterized the year just ended, a progressive improvement in the purchasing power of families is expected, which will lead to a generalized recovery in demand and consequently also in requests for real estate mortgages. The factors supporting the sector will be on the one hand the green component and on the other a situation of stable rates which, although in the medium-high range, will contribute to planning long-term family expenses with greater serenity”.

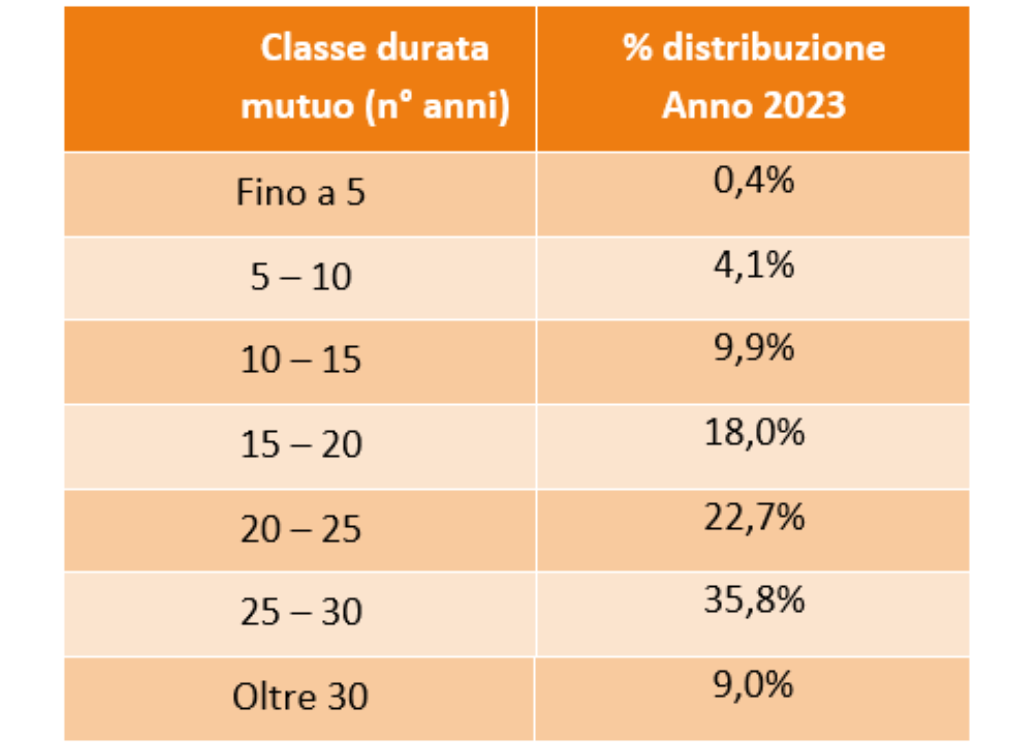

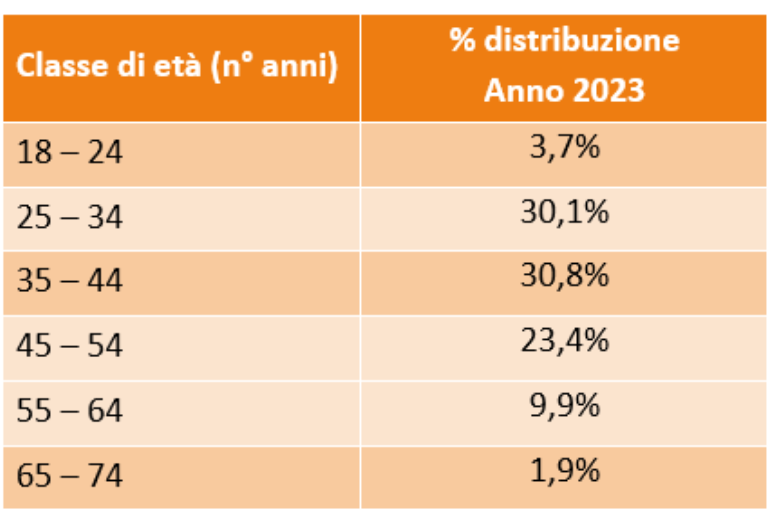

Amounts, duration and age ranges of the application for real estate loans

Even in 2023, the amount range preferred by Italian families is between 100,000 and 150,000 euros, with 29.5% of the total. Next is the 150,000-300,000 euro amount class with a percentage of 25.9%; while almost 40% request amounts of up to 100,000 euros, and only 5.1% exceed 300,000 euros. Over 8 out of 10 requests include repayment plans lasting more than 15 years, and in this way the family budget is not burdened thanks to multiple installments spread over time.

Source: Eurisc – CRIF Credit Information System

Finally, if we analyze the age groups of those requesting a mortgage, over 60% are aged between 25 and 44, while 33.3% are made up of the 45-64 age group.

Source: Eurisc – CRIF Credit Information System