The Financial Stability Board (FSB) published the Peer Review on Italy analysing Italy’s progress to date in reducing NPLs in the banking sector.

This analysis assessed Italy’s recent experience in reducing non-performing loans (NPLs) in the Italian banking sector, focusing on the following areas

accounting, regulatory and supervisory measures put in place to support the management of NPLs in banks’ balance sheets;

measures to facilitate a robust secondary market for the removal of NPLs from bank balance sheets, in particular the guarantee mechanism on the securitisation of bank non-performing loans (GACS); and

measures to improve the efficiency of the legal framework for enforcement, debt restructuring and insolvency.

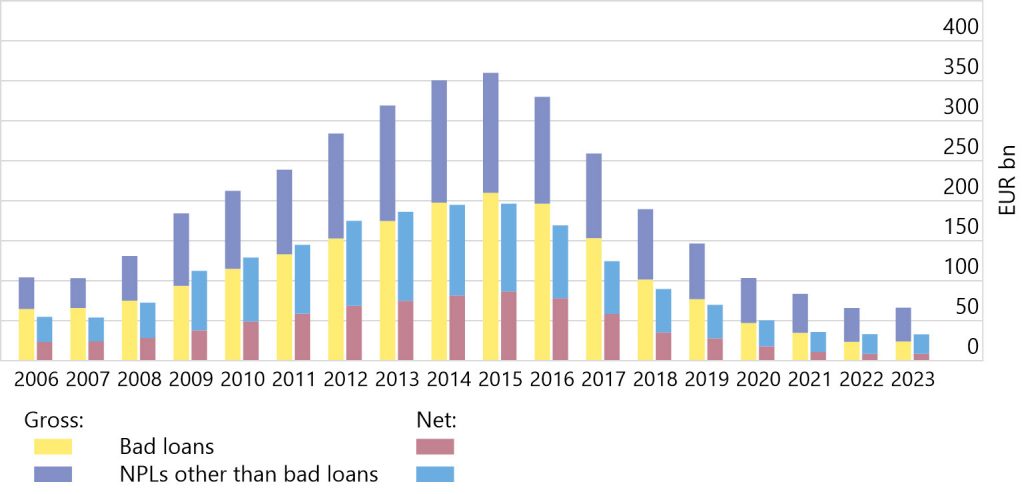

According to the report, the Italian authorities have achieved significant success in reducing NPLs on bank balance sheets from a peak of EUR 360 billion in December 2015 to EUR 63 billion by June 2023.

The peer review report also contains recommendations to the Italian authorities to preserve the success achieved and continue to improve the NPL management ecosystem by promoting the secondary NPL market and closely monitoring and further improving the efficiency of the regulatory framework for insolvency, debt restructuring and debt enforcement.

Ryozo Himino, chairman of the FSB’s Standing Committee on Standards Implementation (SCSI), which oversaw the preparation of the peer review, said, “The concerted efforts of the Italian authorities to address the high levels of NPLs in all areas of regulation, supervision, accounting, development of a secondary market and reform of judicial processes provide a useful framework for other jurisdictions that may face similar problems in the future.”