The Management Company for Assets Arising from the Banking Sector Reorganisation (Sareb) has repaid €3,184 million of state-backed debt, the highest annual figure so far, taking its outstanding debt to €30,481 million. This record figure reflects the company’s decision to expedite the cancellation of its debt in a highly uncertain economic climate marked by rising interest rates. In the ten years since its creation, Sareb has reduced its state-backed debt by €20,301 million, 40% of the original total.

Its commercial and management activities, majority controlled by the Spanish state since April 2022, brought in a total revenue of €2,361 in 2022, up 8% on 2021.

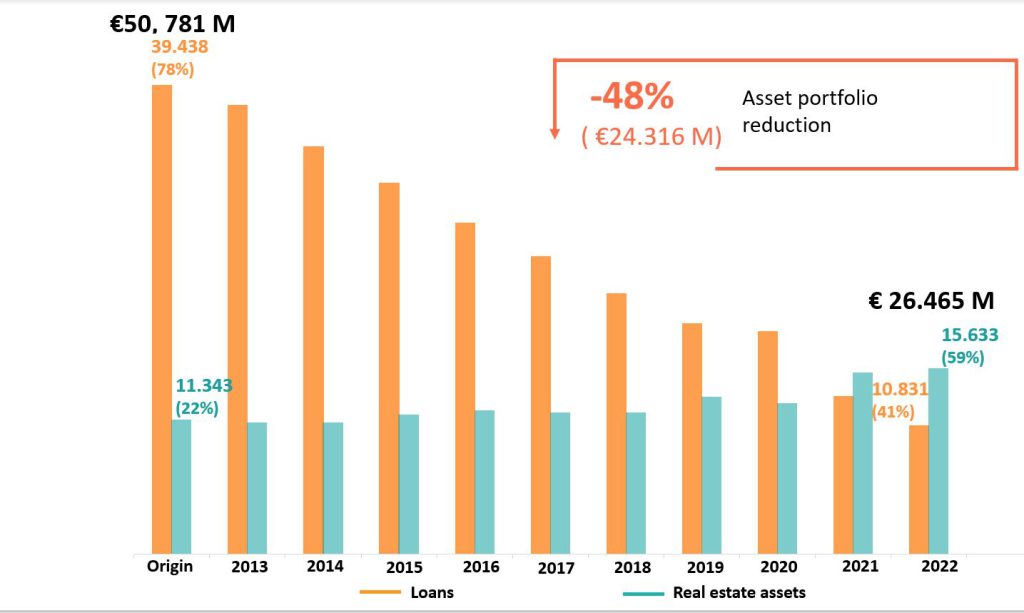

Of this sum, 71% (€1,705 million) accrued from property sales, 15% more than in 2021. Revenue from financial assets, primarily sales of unpaid developer loans, generated €699 million. This figure is 12% lower than in 2021, reflecting the gradual reduction of this part of Sareb’s loan portfolio, which now represents just 41% of assets awaiting disposal.

Strong sales activity in 2022

Sareb sold 27,090 properties in various categories (residential, land and commercial) in 2022, 9% more than in the previous year.

A key factor was the vigorous recovery in the land and commercial property markets, where sales reached a total volume of €310 million and €226 million respectively, up 32% and 49% year on year. Residential sales came in at €825 million, just 5% short of the 2021 figure. This is mainly due to a slowdown in activity in the final stretch of the year, as management was handed over to new servicing companies.

There was very significant growth in sales of assets developed by Árqura Homes, which generated €214 million – climbing 56% year on year.

Sareb’s Chairman, Javier Torres, remarked: “Since the state took control of the company through FROB [Fund for Orderly Bank Restructuring] last year, we have made significant headway in our divestment and debt repayment mandate and pushed forward with our new agenda for sustainability and social impact. We have been laying the groundwork for a new management model focused on maximising the economic and social value of our assets.” Torres also highlighted “Sareb’s efforts to improve corporate governance and the introduction of a new programme for households experiencing vulnerability.”

Efficiency gains boost revenue

Despite an upturn in commercial activity over the course of the year, property management costs dropped 11% to €612 million, thanks to savings achieved through contracts with new servicing companies. It should be noted that a third of these costs are attributable to taxes on Sareb’s portfolio, including non-deductible VAT, property taxes (IBI) and others.

Overheads fell 8% year on year in 2022, the result of an efficiency plan rolled out in 2020. This plan saw redoubled efforts to reduce overheads in 2022, with a view to meeting new needs arising from the evolving profile of Sareb’s portfolio after ten years in operation and from changes in governance following the Spanish state’s acquisition of a majority stake in April 2022.

At the close of 2022, the company posted a loss of €1,506 million, 7.4% less than the €1,626 million recorded in 2021. These losses are largely attributable to the difference between the initial valuation of assets and their realised sales price, and have no bearing on the company’s viability; since 2020 Sareb has been under no obligation to maintain own funds above its requirements in order to operate normally.

Since Sareb was founded, it has reduced its portfolio by 48%, from initial assets of €50,781 to €26,465 at 31 December 2022. Property assets make up 59% of its current portfolio, the remainder being comprised of developer loans with real estate guarantees.

Sustainability and social impact

The Spanish state’s acquisition of a majority stake in Sareb through FROB has led to a push to couple the company’s divestment mandate with a portfolio management model based on sustainability and social benefit. This is being pursued through a three-prong strategy: prioritising property sales to private households and public authorities; introducing a social support programme for vulnerable families living in Sareb properties; and promoting the construction of affordable rental homes.

In 2022, all residential sales for divestment purposes were to private buyers (more than 90% to individuals), with an affordable average price of €97,000. Furthermore, Sareb’s housing stock is available for sale to regional and local authorities, to increase the availability of publicly owned social and affordable rental housing. Also in 2022, Sareb introduced a social support programme for vulnerable families living in 9,000 of its properties. Those identified as vulnerable are eligible for social rents and a package of support measures to help them find employment, in which they take a proactive role. Sareb currently manages more than 2,000 social rentals.

Source: Sareb