A recent study by Experian US reveals that American consumers have accumulated an additional debt totaling $73 billion over a year (survey conducted in the period from the second quarter of 2022 to 2023). Consumer credit balances have increased substantially across various credit types, albeit unevenly, resulting in an overall 4.5% increase. Overall, consumers owe a staggering $16.84 trillion to the banking/financial system.

While significant, the percentage increase was much lower than the previous survey period (Q2 2021-Q2 2022), during which the recorded increase was 7%.

In percentage terms, the debt accrued from credit card and personal loan segments grew the most in 2023, increasing by 16.3% and 21.3% respectively. While these percentage changes are significant, in quantitative terms, the $150 billion increase in these two credit categories falls well below the $500 billion increase in the total consumer mortgage balance.

Total Debt Balance by Debt Type (Fonte Experian)

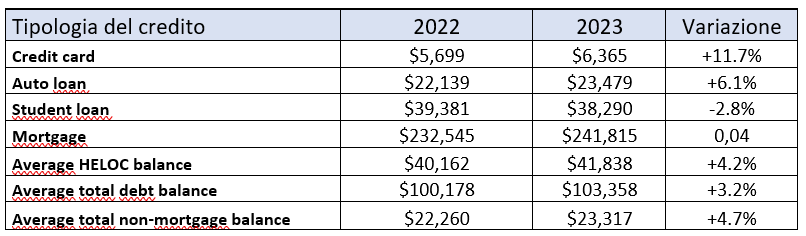

Change in Average Balance by Debt Category (Fonte Experian)