In 2023, the Italian loan market showed a fluctuating dynamic: growth in the first five months, followed by a slowdown in the following months.

Looking at the overall data, we note that, albeit with discontinuity, requests remained stable overall, with a +0.4% compared to 2022, according to EURISC, the Credit Information System managed by CRIF.

Analyzing in detail the technical forms of credit demand, the requests for finalized loans were most affected by this intermittent trend with a -10.4%, while personal loans held the sector with a +18.9% .

Simone Capecchi, Executive Director of CRIF comments on the data as follows: “2023 was the year of caution, both with regards to families who scaled back their spending plans, and from the point of view of supply, with greater attention on credit access criteria due to the uncertainty generated by the geopolitical context, inflation and the increase in interest rates by the ECB. The forecasts for the year that has just begun show that the expansion of credit stocks will be lower than the performances of the 2021-2022 two-year period, also because the greater expected risk will keep supply policies cautious. The recommendations of the supervisory bodies go in this direction, urging operators to maintain high attention on the demand for credit”.

Trend in requests for new loans (personal + finalized)

Source: Eurisc – CRIF Credit Information System

The average amount starts to rise again, but the installments are diluted over time

The average amount of financing requested, after 3 negative years, returns to grow with +4.0% and a value of 8,427 euros. The positive trend involves finalized loans with a value of 5,862 euros (+2.5% compared to 2022), while personal loans drop to 11,759 euros (-3.8% vs 2022).

If we consider the loans by amount range, the cumulative data shows how one in two Italians requests amounts lower than 5,000 euros (54.4% of the total), followed by the slightly higher brackets: 10,000-20,000 euros (17.3%) and 5,000-10,000 euros (16.4%).

The application, although mainly for small amounts, is deferred over a period of more than 5 years for 27.3% of Italians, to weigh as little as possible on the family budget.

The prudent attitude of Italian families is also reflected in the cross-section of the two technical forms examined: 76.3% of finalized loan requests have the debt repaid within 3 years; while personal loans, which often represent a particularly burdensome commitment for families, tend to be concentrated beyond five years, 50.2% of the total.

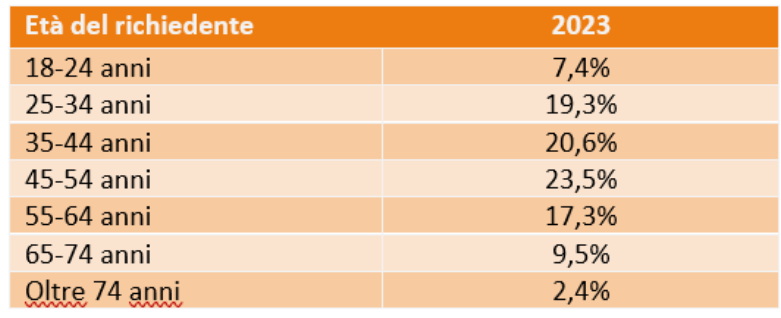

Finally, the CRIF Barometer highlights the distribution of loan requests in relation to the age of the applicant: in 2023 the group between 25 and 54 years was the majority, with a share equal to 63.4% of the total.

Source: Eurisc – CRIF Credit Information System